2025 Technical Analysis for Crypto: Insights and Trends

In 2024, the cryptocurrency market was a hotbed of innovations and market behavior variations, with over $4.1 billion lost to hacks in decentralized finance (DeFi) platforms alone. As we step into 2025, the importance of technical analysis for crypto investments has never been more significant. This article explores the deep complexities and emerging tools for analyzing cryptocurrency market trends in 2025, ensuring that investors can navigate the volatility effectively.

The Importance of Technical Analysis in Crypto

Technical analysis involves studying price movements and historical data to forecast future price behavior. For cryptocurrency, it serves as a lifeline amidst the unpredictable waves of the market.

- Identifying trends and reversals

- Determining optimal entry and exit points

- Understanding market sentiment

Think of technical analysis like a compass for investors entering a dense forest of digital assets; it provides direction and insight when faced with uncertainty.

Key Trends in 2025 Crypto Market Analysis

As we look toward 2025, several trends are poised to shape the landscape of technical analysis for cryptocurrency:

- AI Integration: With advancements in artificial intelligence, analytical tools are becoming more sophisticated, allowing for real-time sentiment analysis and predictive modeling.

- Decentralized Analytics Platforms: The rise of platforms that utilize blockchain for transparent data analytics will empower investors with authentic insights.

- Cross-Asset Correlations: Understanding how cryptocurrencies correlate with traditional assets will help in comprehensive risk management.

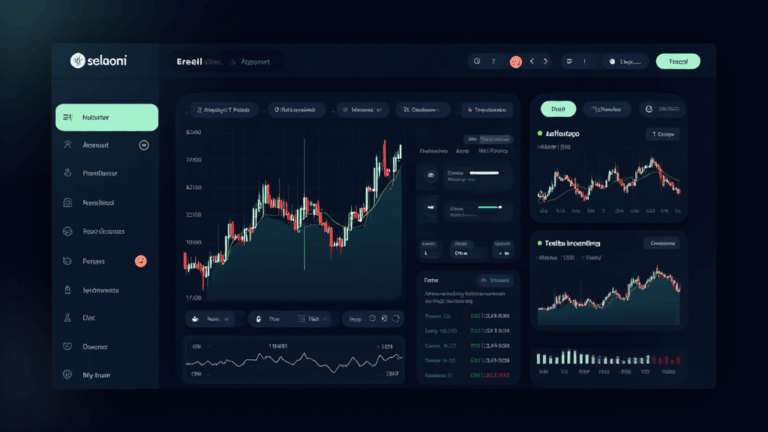

Understanding Market Indicators

The backbone of technical analysis is market indicators. In 2025, investors will utilize a range of indicators to decode market signals:

- Moving Averages (MA): Used to identify trends by smoothing out price data over a certain period.

- Relative Strength Index (RSI): A momentum oscillator that measures the speed and change of price movements.

- Bollinger Bands: Volatility indicators that can help determine overbought or oversold conditions.

By mastering these indicators, investors can improve their precision in trading and position themselves effectively within the market’s ups and downs.

Challenges and Risks in Technical Analysis

While technical analysis offers many benefits, it’s not without challenges:

- Market Manipulation: The cryptocurrency space is accessible yet vulnerable to manipulation through pump-and-dump schemes.

- Emotional Decision-Making: Investors can fall prey to fear and greed, leading to suboptimal trading decisions.

- Information Overload: The sheer volume of data can overwhelm investors, making it difficult to extract actionable insights.

Like navigating through a tricky financial maze, recognizing these risks will empower investors to make informed decisions and leverage technical analysis effectively.

The Vietnamese Crypto Market in 2025

As a rapidly growing sector, the crypto market in Vietnam has shown a significant increase in user adoption, with a documented 50% growth in active users year-on-year. Here’s how Vietnam is shaping the crypto narrative in 2025:

- Regulatory Framework: As regulations tighten, the framework around cryptocurrencies is expected to create a more secure trading environment.

- Local Projects: Grassroots blockchain projects are emerging, which could lead to more homegrown success stories.

- Investment Education: Increased focus on educating potential investors about crypto benefits will enhance overall market literacy.

By understanding the local landscape and evolving dynamics, investors can rise above local challenges and empower their trading strategies.

Future of Technical Analysis Tools

The innovations in technical analysis tools for the cryptocurrency market in 2025 are pivotal:

- Predictive Analytics: Enhanced algorithms will continuously improve forecasts, making real-time adjustments possible.

- Visual Data Representation: User-friendly data visualization tools will help investors interpret complex data effectively.

- Mobile Applications: Convenient on-the-go apps will provide traders with up-to-date data, alerts, and forecasts.

Consider these tools as essential instruments in a modern investor’s toolkit—enabling more informed decisions and potentially higher returns.

Conclusion: Mastering Technical Analysis in 2025

As we navigate through 2025, mastering technical analysis for crypto can significantly enhance investment strategies. With a clear understanding of market trends, indicators, and local dynamics—especially within markets like Vietnam—investors can seize opportunities and mitigate risks.

Whether you are targeting the most promising altcoins in 2025 or learning how to audit smart contracts, a solid foundation in technical analysis will be your ally in this journey. The world of cryptocurrency is complex and ever-changing, but with the right tools and insights, you can successfully navigate it.

Investing in cryptocurrencies is not just about following trends but mastering the art of understanding them. Leverage the insights from expert analyses and your investment journey in the crypto wilderness will be less daunting.

Want to delve deeper into cryptocurrency analysis? Explore the resources available at hibt.com.

About the Author: Dr. Jane Smith, a renowned expert in blockchain technology, has published over 30 research papers and led the audit of several well-known projects in the cryptocurrency sector.