Introduction

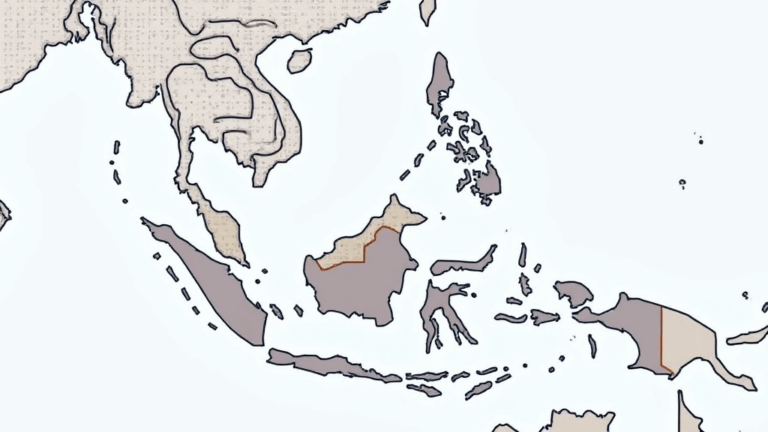

As the cryptocurrency market continues to expand, lawmakers around the globe are racing to formulate regulations that provide security for users and transparency for businesses. In 2024 alone, over $4.1 billion was lost to hacks and scams in decentralized finance (DeFi) platforms. The alarming figures underscore the urgent need for comprehensive regulation. This article explores the concept of regulatory harmonization in ASEAN crypto, highlighting its significance and the potential benefits for the region.

The Importance of Regulatory Harmonization

Regulatory harmonization refers to the process of aligning regulations across different jurisdictions to create a unified legal framework. In the context of Southeast Asia, where varied regulatory landscapes exist, harmonization can streamline compliance for crypto businesses.

Benefits for Businesses and Consumers

- Increased Security: By standardizing regulations, consumers can enjoy a higher level of protection against fraud.

- Ease of Doing Business: Businesses can operate across borders without the hassle of navigating different local laws.

- Market Growth: A stable regulatory environment attracts investment and promotes market growth.

Current State of Crypto Regulations in ASEAN

As of 2024, the regulatory framework for cryptocurrencies in ASEAN member states remains fragmented. Countries like Singapore and Thailand are leading the way with more comprehensive regulations, while others lag behind, creating a discrepancy that complicates operations for crypto businesses.

Country-Specific Insights

In 2023, Vietnam saw a staggering growth rate of 154% in cryptocurrency users, which necessitates responsive regulatory measures. Meanwhile, Indonesia is grappling with a strict ban on crypto transactions but is exploring ways to introduce a framework that promotes security.

| Country | Current Status | Growth Rate |

|---|---|---|

| Vietnam | Emerging framework | 154% |

| Singapore | Comprehensive regulations | 30% |

| Thailand | Advanced guidelines | 20% |

| Indonesia | Exploring regulations | N/A |

Key Challenges to Harmonization

Despite the potential benefits, several challenges hinder regulatory harmonization in ASEAN:

- Diverse Legal Frameworks: Member states have varied legal definitions and treatment of cryptocurrencies.

- Political Differences: National interests may complicate collaborative efforts.

- Lack of Expertise: Many countries are still developing the necessary knowledge and technical capability to create comprehensive regulations.

Strategies for Implementing Harmonization

To overcome these challenges and achieve regulatory harmonization, ASEAN countries can employ the following strategies:

1. Collaborative Policy Development

ASEAN can facilitate discussions between member states to develop a common regulatory framework. This would involve utilizing platforms like the ASEAN Blockchain Consortium to share ideas and best practices.

2. Capacity Building

Investing in capacity building helps local regulators understand blockchain technologies and their implications. Trainings and workshops can be organized, focusing on areas such as tiêu chuẩn an ninh blockchain (blockchain security standards).

3. Public-Private Partnerships

Collaboration between governments and the private sector can facilitate the development of standards that are both effective and practical.

Case Study: Singapore’s Approach

Singapore has established itself as a leading hub for cryptocurrency regulation in the region. The Monetary Authority of Singapore (MAS) introduced the Payment Services Act in 2020, which provides a robust framework for cryptocurrency service providers. This proactive approach has fostered innovation while ensuring consumer protection.

As a result, Singapore attracted significant investment, bolstering its economy. Other ASEAN countries can learn from Singapore’s regulatory practices, adapting them to fit their unique contexts while striving for harmonization.

Conclusion

The future of cryptocurrency in the ASEAN region hinges on effective regulatory harmonization. With the rise of digital assets, countries must come together to create a cohesive framework that ensures security and fosters growth. By addressing existing challenges and implementing strategic initiatives, ASEAN can position itself as a global leader in crypto regulation.

Ultimately, creating a unified regulatory environment is crucial not only for businesses but also for enhancing consumer confidence. With a well-executed harmonization strategy, the region can unlock the full potential of the cryptocurrency industry.

For further insights into the evolving regulations and opportunities in the ASEAN crypto market, visit bitcoin10000.

Expert Author: Dr. Anna Tran – a renowned blockchain policy expert with over 25 published papers in the field and has overseen the audits of several leading cryptocurrency projects.