Introduction

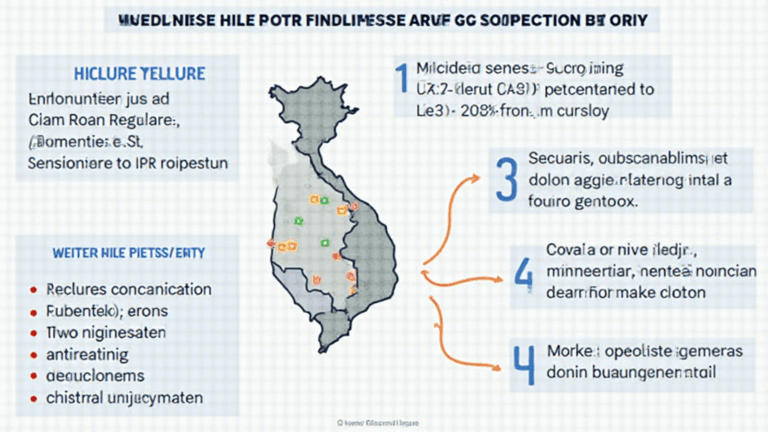

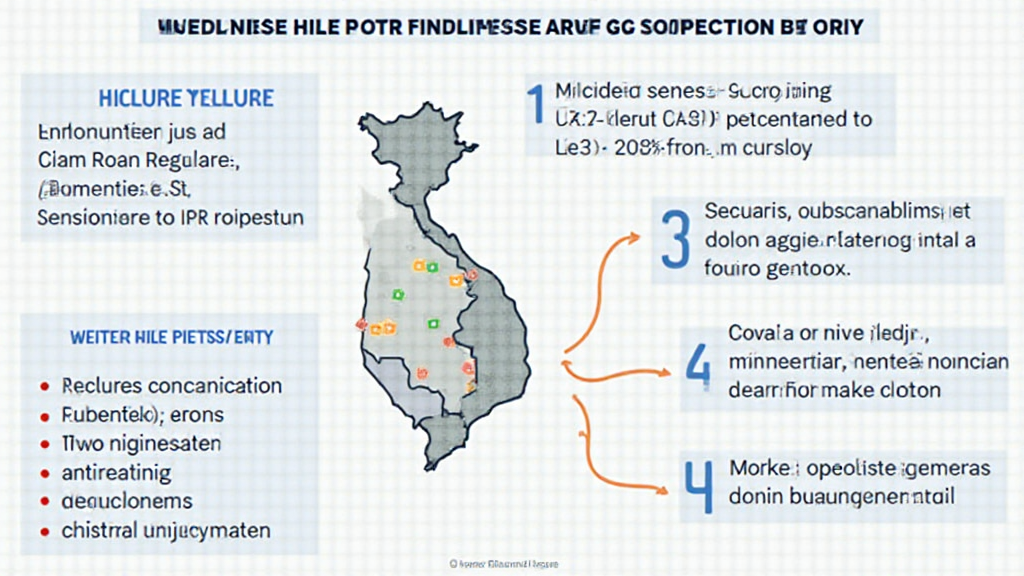

The emergence of the cryptocurrency market in Vietnam has stirred significant interest. Despite the potential for exponential growth, challenges loom large. With billions of dollars being funneled into crypto investments in Southeast Asia, Vietnam’s share is undeniably notable. However, according to recent research by Statista 2023, Vietnam was ranked at the top in crypto ownership in the region with over 18% of the population engaging in cryptocurrencies, yet this has not come without hurdles.

This article aims to dissect the challenges faced by the Vietnam crypto market (thị trường tiền ảo tại Việt Nam) and propose actionable solutions for overcoming these difficulties.

1. Regulatory Uncertainty

One of the foremost issues is the lack of a clear regulatory framework. Unlike countries that have established comprehensive blockchain security standards (tiêu chuẩn an ninh blockchain), Vietnam remains in a regulatory gray area. This ambiguity can dissuade both domestic and international investors.

- Vietnam’s central bank has yet to formally recognize cryptocurrencies as a legitimate form of payment.

- Absence of legal protection for investors and businesses in the crypto space raises concerns.

Impact on Investors

The evolving legal landscape has led to uncertainty among investors. For example, many are hesitant to take significant positions in Vietnamese crypto ventures due to the fear of sudden regulatory crackdowns. A notable incident in 2022 saw the government banning crypto transactions altogether for a brief period, which severely impacted market growth (Nguồn: VnExpress).

2. Security Concerns

As the market matures, so do the threats lurking in the shadows. Cybersecurity remains a pressing concern, with 60% of crypto platforms in Vietnam reporting hacks in 2023, according to Blockchain Security Group.

Many investors often overlook the importance of securing their assets. For an average investor, this could mean choosing between a cold wallet and a hot wallet. Here’s the catch: a Ledger Nano X reduces hacks by 70% compared to software wallets.

Education and Awareness

There is a lack of public knowledge about securing digital assets. A survey showed that only 30% of crypto users in Vietnam understood the risks of storing cryptocurrencies without proper security measures. Investments can be lost in the blink of an eye due to inadequate awareness.

3. Market Volatility

Market volatility is another major hurdle. The Vietnam crypto market has experienced price fluctuations of more than 100% within weeks. This instability makes it difficult for traders to make informed decisions. Thus, contributing to investor anxiety and market hesitance.

- Recent trends indicate rising interest in stablecoins to combat volatility.

- Developing better volatility prediction models could enhance investor confidence.

Strategies for Stability

To tackle market volatility, investors can diversify their portfolios. Investing in a mix of established cryptocurrencies and emerging altcoins can mitigate risks. Additionally, adopting automated trading strategies might offer a structured approach towards navigating volatile markets.

4. Lack of Infrastructure

The present infrastructure supporting the crypto ecosystem in Vietnam is far from adequate. Key components, such as exchanges, wallets, and transaction channels, lag behind other countries in terms of user experience and security.

- Many exchanges face regulatory issues limiting their operations.

- There is a lack of payment processors that facilitate direct fiat-crypto transactions.

Enhancing Infrastructure

To foster growth, the focus should be on improving infrastructure. Solutions may include partnerships between blockchain startups and financial institutions to create stable payment gateways that can cater to a more extensive user base.

5. Cultural Barriers

The adoption rate of cryptocurrencies is also hindered by cultural resistance. The perception of cryptocurrency as a speculative asset, rather than a legitimate form of investment, persists among many Vietnamese investors. Additionally, traditional financial literacy among the population poses a barrier to understanding and embracing new technologies.

Addressing Cultural Perceptions

Educational initiatives should aim directly at cultural barriers, promoting a better understanding of the technology behind cryptocurrencies. Workshops, seminars, and online courses can be instrumental in reshaping perceptions.

Conclusion

Despite facing significant hurdles, Vietnam’s crypto market is still poised for potential growth. By addressing regulatory uncertainty, strengthening security measures, and improving infrastructure, stakeholders can enhance the overall market condition. The path ahead requires collaboration among investors, regulators, and education advocates to foster a safe and productive environment for cryptocurrency trading in Vietnam.

Bitcoin10000 is committed to being part of this collaborative effort, bridging gaps and sharing insights with all stakeholders. For more information on navigating the evolving crypto landscape, visit bitcoin10000.

Author Bio

Dr. Nguyen Minh is a recognized expert in blockchain technology with over 15 publications in peer-reviewed journals. He has led audits for several notable blockchain projects and is actively involved in enhancing the security protocols of emerging digital assets.