Vietnam Crypto Liquidity: Harnessing Growth in 2025

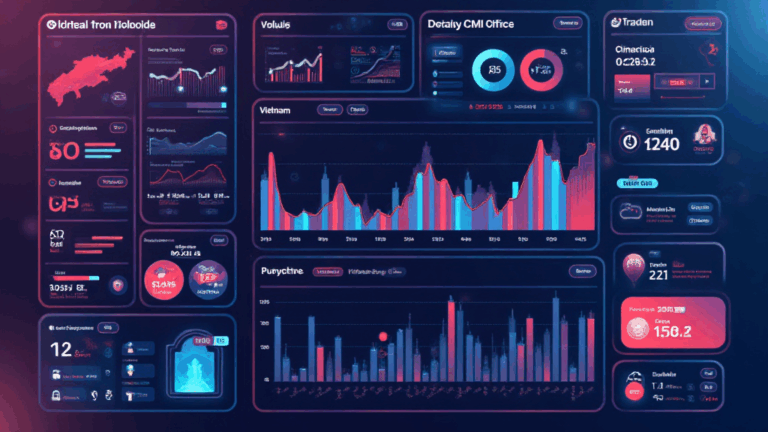

As digital currency adoption grows globally, Southeast Asia is witnessing a surge in cryptocurrency activity, particularly in Vietnam. In 2024, the Vietnamese crypto market recorded a remarkable growth rate of 41%, driven by an influx of users and investments. With over $4.1 billion lost to DeFi hacks in the past year, understanding Vietnam’s crypto liquidity has never been more crucial.

This article aims to delve into the intricacies of crypto liquidity in Vietnam, examining its significance, current landscape, and potential future developments. By leveraging localized data and insights, we aim to provide a comprehensive overview for those interested in navigating this vibrant market.

Understanding Crypto Liquidity

Crypto liquidity refers to the ease with which a cryptocurrency can be bought or sold in the market without significantly affecting its price. High liquidity typically indicates a strong market presence and trader confidence. In Vietnam, the liquidity situation is evolving rapidly as more platforms enter the space and demand surges.

The Importance of Liquidity in Vietnam

For traders and investors, liquidity is crucial for several reasons:

- Price Stability: Higher liquidity promotes smoother price movements, reducing the potential for drastic price swings.

- Efficient Trades: Trading in high liquidity markets allows for quicker execution of orders.

- Market Confidence: An active trading environment can foster investor confidence, attracting more participants.

As Vietnam’s economy continues to develop, the importance of liquidity cannot be overstated. Recent reports indicate that nearly 70% of Vietnamese crypto users are new to the market, highlighting the need for platforms that can facilitate seamless trading experiences.

The Current Landscape of Vietnam’s Crypto Market

The crypto environment in Vietnam is characterized by a mix of local exchanges and international platforms. Major players have emerged, such as Hibt.com, which focuses on providing robust liquidity solutions tailored for Vietnamese traders.

Key Market Participants

- Local Exchanges: Vietnamese exchanges like Coin98 and VBTC provide platforms specifically designed to cater to local users.

- International Platforms: Global exchanges like Binance and Huobi have also begun to increase their presence in the region.

Market Data

According to CoinMarketCap, as of 2024, Vietnam has seen a 24% increase in the trading volume of cryptocurrencies. Furthermore, reports indicate that the number of crypto wallets in Vietnam surpassed 2 million, highlighting a significant engagement level with digital assets.

Factors Influencing Crypto Liquidity in Vietnam

Several key factors play a role in shaping the liquidity landscape in Vietnam:

- Regulatory Framework: The Vietnamese government has been working on defining clear regulations for cryptocurrency, which could impact liquidity positively.

- Market Participation: With the rise of retail investors, liquidity is expected to grow as more individuals seek to invest in cryptocurrencies.

Investment Trends

Investments in cryptocurrencies have soared in Vietnam, with a projected 55% increase anticipated by the end of 2025. Notably, investors are increasingly interested in altcoins, with emerging projects promising significant returns.

In line with this trend, in 2025, the top potential altcoins expected to dominate include:

- Cardano (ADA): Noted for its scalability and sustainability.

- Polygon (MATIC): Recognized for its layer-2 scaling solutions.

Challenges Facing Crypto Liquidity in Vietnam

Despite the growth potential, several challenges could hinder liquidity:

- Market Volatility: The crypto market is known for its price volatility, making liquidity management complicated.

- Security Concerns: High-profile hacks have made investors wary, leading to hesitance in trading.

Mitigating Risks

To address these challenges, investors and platforms are deploying enhanced security measures and leveraging tools like smart contract audits. If you’re interested in how to audit smart contracts, consulting with experts familiar with Vietnamese regulations can provide essential insights.

The Future of Crypto Liquidity in Vietnam

As we look towards 2025, the future of crypto liquidity in Vietnam is bright. Anticipating a surge in interest from both domestic and international investors, the landscape is set for continued evolution.

Predicted Trends

- Increased Institutional Adoption: With the regulatory frameworks becoming clearer, institutional investors are likely to enter the market.

- Emergence of New Projects: The Vietnamese crypto scene is home to budding projects that could enhance liquidity.

Furthermore, the integration of the Vietnamese dong with cryptocurrencies could provide a smoother trading experience. Such developments highlight the exciting possibilities that lie ahead for Vietnam’s crypto liquidity.

Data suggests that nearly 85% of cryptocurrency users in Vietnam express a strong interest in integrating digital assets with traditional finance. This trend is reflective of a broader global shift toward crypto adoption.

Conclusion

Vietnam is at a pivotal moment in its cryptocurrency journey. With increasing user engagement and market participants, crypto liquidity is set for substantial growth. By understanding the trends and challenges highlighted in this article, individuals and businesses can prepare to navigate this promising market effectively.

As the landscape evolves, staying informed will be essential. For continued insights into crypto best practices and liquidity solutions, consider following bitcoin10000.

About the Author

Dr. Minh Nguyen, a blockchain researcher with over 15 publications in the field, specializes in decentralized financial systems. He has led audits for notable projects within the Vietnamese market and is committed to advancing the understanding of blockchain technology.