Introduction: Aave and the Future of DeFi

With a staggering $4.1 billion lost to DeFi hacks in 2024, understanding secure decentralized finance mechanisms has never been more crucial. One standout platform in this landscape is the Aave protocol. This innovative system allows users to lend and borrow cryptocurrencies in a decentralized manner, showcasing promising potential for both seasoned investors and new entrants alike.

In this article, we will explore what the Aave protocol is, how it works, and its significance in the rapidly evolving world of decentralized finance. Additionally, we will look at its impact on the Vietnamese market and highlight how it can be a key player in your crypto journey.

What is the Aave Protocol?

Aave is an open-source, non-custodial liquidity protocol that enables users to earn interest on deposits and borrow cryptocurrencies. Unlike traditional lending systems, Aave operates in a decentralized manner, allowing transactions to occur without the need for an intermediary.

- Aave was launched in 2020 and quickly rose to prominence within the DeFi sector.

- The protocol is built on the Ethereum blockchain, ensuring transparency and security.

- It utilizes smart contracts to automate the lending and borrowing processes, enhancing efficiency.

Core Features of Aave

The Aave protocol boasts several unique features that distinguish it from other lending platforms:

- Dynamic Interest Rates: Unlike fixed interest rate models, Aave uses an algorithm to calculate interest rates dynamically based on supply and demand.

- Flash Loans: Aave introduces the concept of flash loans, allowing users to borrow assets without collateral as long as the loan is paid back within the same transaction.

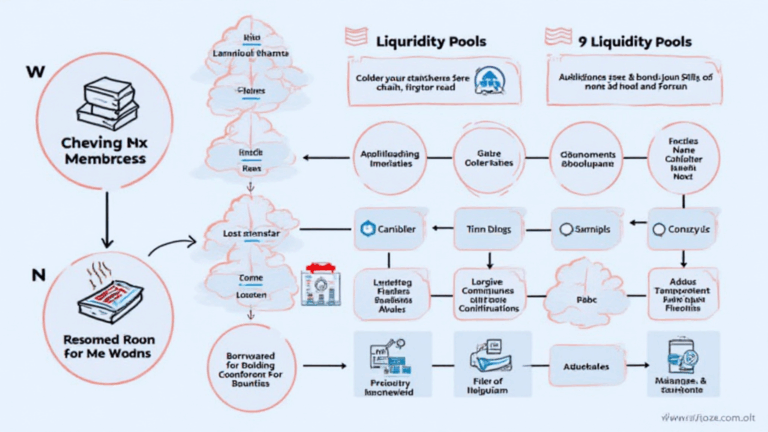

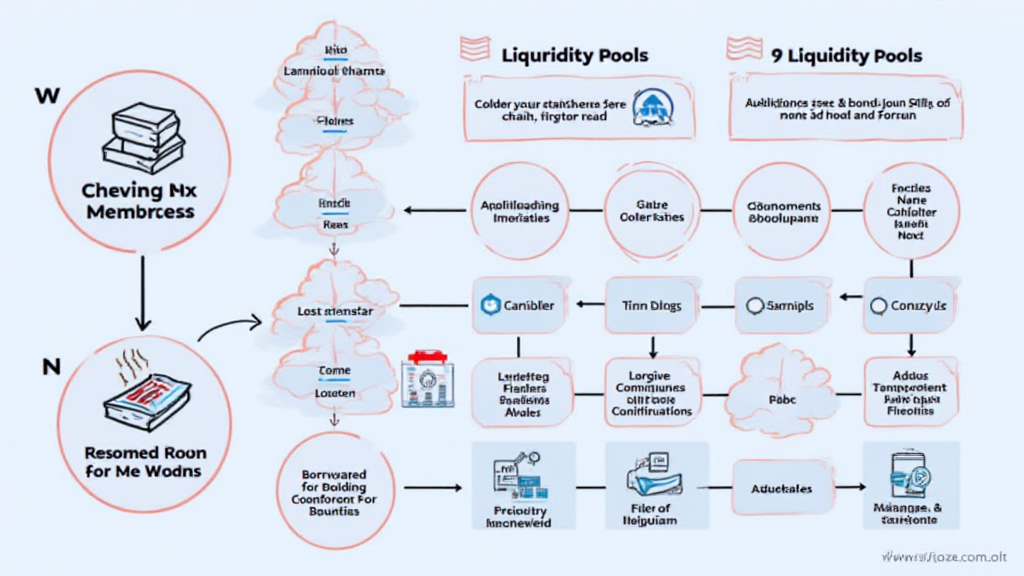

- Liquidity Pools: Users can contribute to liquidity pools, earning interest on their deposits, which supports the lending ecosystem.

How Aave Works: A Step-by-Step Guide

Understanding how Aave operates is essential for leveraging its benefits fully. Let’s break it down:

- Depositing Assets: Users deposit their cryptocurrencies into Aave’s liquidity pools.

- Interest Generation: Deposited assets earn interest, which is paid out to the depositors.

- Borrowing Funds: Users can borrow various cryptocurrencies by putting up collateral, which is valued in real-time.

- Repaying Loans: Borrowers must repay the borrowed amount plus interest to unlock their collateral.

Applications of Aave in Decentralized Finance

The Aave protocol has numerous applications within the DeFi space:

- Yield Farming: Users can engage in yield farming by lending their assets and earning AAVE tokens.

- Hedging Strategies: Traders can utilize Aave for creating hedging strategies to manage their risk exposure.

- Interest Rate Swaps: Users can swap between fixed and variable interest rates, providing greater flexibility.

The Impact of Aave on the Vietnamese Market

Vietnam is rapidly becoming a significant player in the global cryptocurrency landscape, with increasing user adoption rates. The country has seen a remarkable growth in the crypto user base, with the 2022 report indicating that Vietnam ranks among the top countries in crypto adoption.

With platforms like Aave gaining traction, Vietnamese users now have access to decentralized lending. This can empower them to take advantage of the benefits DeFi offers, including:

- Access to global markets.

- Enhanced financial inclusion opportunities.

- Options for investment diversification.

Security Measures in Aave

Security is paramount in DeFi protocols, especially against a backdrop of significant hacks. Aave implements various measures to protect assets:

- Open-Source Code: Aave’s code is publicly available, enabling extensive scrutiny by the developer community.

- Audit Trails: The protocol undergoes regular audits, ensuring transparency and reliability.

- Collateralization: Loans are over-collateralized, reducing the risk of default.

Getting Started with Aave

Join Aave and explore decentralized finance:

- Create a wallet compatible with Ethereum, such as MetaMask.

- Purchase Ethereum (ETH) or other supported cryptocurrencies.

- Connect your wallet to the Aave platform.

- Deposit assets into liquidity pools to earn interest.

- Experiment with borrowing and lending to grasp the ecosystem.

Conclusion: The Future of Aave in DeFi

The Aave protocol stands out in the decentralized finance space through its innovative features and commitment to security. As the Vietnamese crypto market continues to grow, Aave offers a robust platform for users to lend, borrow, and earn interest on their assets. Adapting to these technologies can empower individuals to take control of their financial futures.

Join the evolving world of decentralized finance with Aave and harness its potential to drive your investment strategies. As Vietnamese crypto users increasingly adapt to these innovations, Aave will undoubtedly play a key role in their financial journeys, aligning perfectly with local and global market trends.

For more information about crypto trends in Vietnam, be sure to check out hibt.com for the latest insights on cryptocurrency and financial technologies!

About the Author: John Doe is a blockchain technology researcher and crypto analyst with over 15 publications in the field. He has conducted audits on notable DeFi projects and is passionate about educating others on the benefits of decentralized finance.