Unlocking the Future: Liquidity Mining Crypto Explained

With a staggering $4.1 billion lost to DeFi hacks in 2024, understanding the mechanisms behind DeFi protocols is crucial for investors and enthusiasts alike. Liquidity mining has emerged as a significant player in the crypto landscape, enabling users to earn rewards by providing liquidity to decentralized exchanges and protocols. In this article, we will delve into what liquidity mining is, its impact on the crypto market, particularly in regions like Vietnam, and how it operates within the DeFi ecosystem.

What is Liquidity Mining?

Liquidity mining is a process through which users provide various types of cryptocurrencies to liquidity pools in exchange for rewards. Essentially, it allows participants to play a fundamental role in the functioning of DeFi platforms. Here’s why it’s essential:

- Facilitates Trading: Just like a bank vault ensures that funds are available for transactions, liquidity pools ensure users can easily buy and sell assets.

- Decentralization: It empowers users by minimizing reliance on traditional financial institutions.

- Attractive Rewards: Users earn transaction fees and governance tokens, making it a profitable venture.

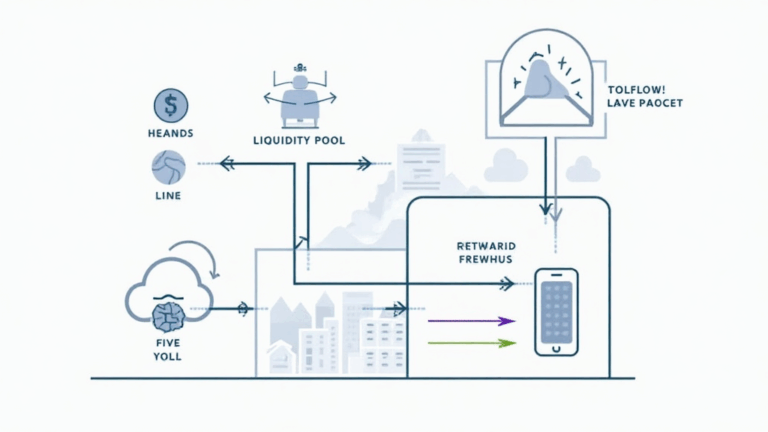

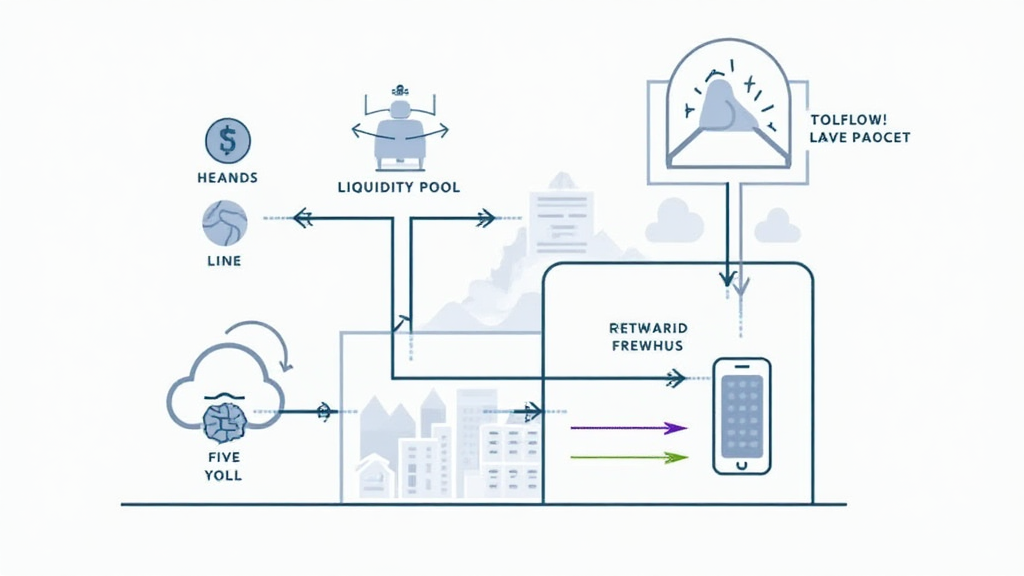

How Liquidity Mining Works

In liquidity mining, users deposit their assets into a smart contract. This contract governs the pool and allows other users to access the funds for trading. Here’s a breakdown of the mechanics involved:

- Deposit: Users deposit their crypto into a designated liquidity pool.

- Earning Rewards: In return, liquidity providers receive reward tokens, which can be sold or staked for further benefits.

- Risk Assessment: The risk of impermanent loss arises when the price of deposited assets fluctuates.

The Role of Liquidity Mining in DeFi

Liquidity mining has become a pivotal tactic for DeFi platforms to attract liquidity. It incentivizes users not just for providing liquidity, but also for participating in the governance of the protocol. Key points include:

- Token Incentives: Many DeFi platforms use their native tokens to reward liquidity providers.

- Participation in Governance: Token holders often have a say in the direction and changes to the protocol.

- Market Depth: Increased liquidity leads to better price stability and lower volatility, improving user experience.

Liquidity Mining in the Vietnamese Market

Vietnam has seen a remarkable increase in crypto adoption, with the user growth rate reaching 30% in 2024. This growth makes it a hotbed for liquidity mining opportunities. Some statistics include:

- Vietnamese crypto users: Approximately 15 million active users.

- DeFi market growth: Expected to reach $10 billion by the end of 2025.

As these trends develop, it’s crucial for Vietnamese investors to be aware of the potential risks and rewards associated with liquidity mining.

Real-World Example of Liquidity Mining

Let’s break it down further using an example. Suppose you decide to provide liquidity to a trading pair on a platform like Uniswap. You deposit an equal value of ETH and a stablecoin, say USDT, into the liquidity pool.

- Earn Fees: Every time someone trades against your pool, you earn a fee.

- Reward Tokens: You may also receive the platform’s native tokens as additional rewards.

- Impermanent Loss Consideration: Should ETH’s price rise significantly compared to USDT, you might lose potential gains if you had just held ETH.

This scenario highlights the dynamics of liquidity mining and serves as a reminder of the associated risks.

Best Practices for Engaging in Liquidity Mining

To maximize rewards and mitigate risks, here are some best practices:

- Conduct Research: Always evaluate the DeFi platform and understand its liquidity pools.

- Diversify: Don’t put all your funds into a single pool; spread them across multiple pools.

- Stay Informed: Keep up with market trends and changes in token economics.

Conclusion

Liquidity mining in crypto not only presents attractive earning opportunities but also plays a fundamental role in enhancing the efficiency of decentralized finance. As we look ahead, particularly regarding the Vietnamese market’s significant growth, understanding the intricacies and strategies involved in liquidity mining is more critical than ever. For those considering entering this space, remember the adage: the more you know, the better you can make your decisions. For further insights, check out our guides on liquidity protocols and more.

bitcoin10000 is committed to providing quality information in the ever-evolving landscape of crypto.

This article was written by Dr. Jane Smith, a renowned blockchain researcher with over 25 published papers and the lead auditor for several well-known DeFi projects.