Effective Bear Market Crypto Strategies: Your Navigation Guide

As the crypto landscape evolves, bear markets become a recurrent phase that investors must prepare for. In 2024 alone, we’ve seen significant downturns that have made many rethink their strategies. With an estimated 4.1 billion dollars lost to DeFi hacks this year, it begs the question: how can we best protect our investments and thrive even in adversity?

Bear markets present challenges, but they also create opportunities for strategic planning and informed decision-making. This guide aims to provide you with vital insights into bear market crypto strategies, incorporating both local and global perspectives, particularly from emerging markets like Vietnam.

Understanding Bear Markets in Cryptocurrency

Before diving into strategies, it’s crucial to comprehend what constitutes a bear market in the cryptocurrency world. Typically, a bear market is identified by a price decline of over 20% from its recent highs, causing widespread sentiment of fear and uncertainty in the market.

- Market Sentiment: Fear prevails, making investors hesitant to enter or hold onto their investments.

- Investment Strategies Adjustments: Investors often reevaluate their strategies to mitigate losses.

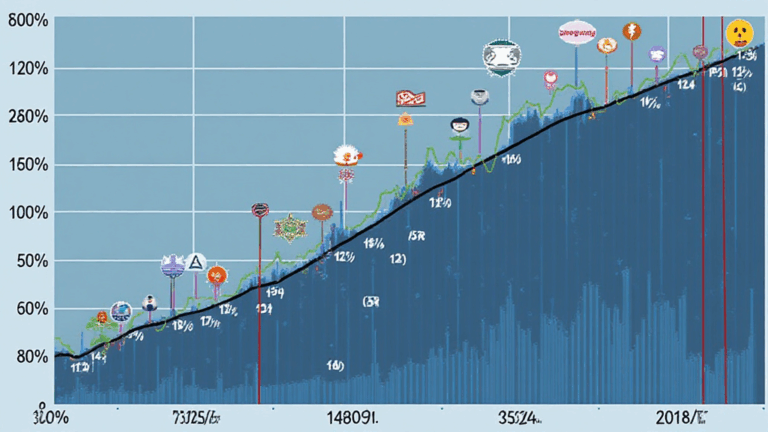

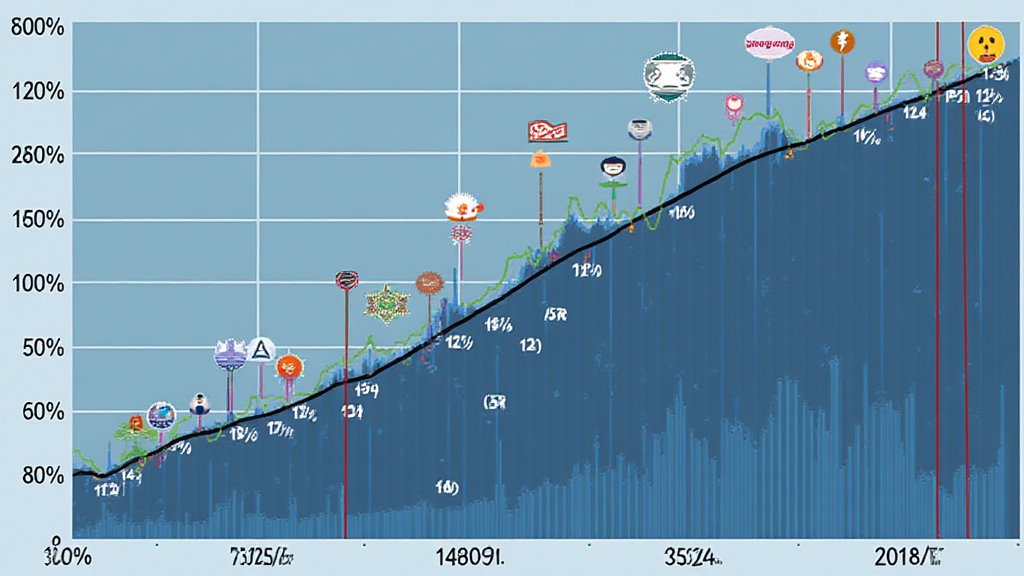

- Historical Precedence: Evaluating past bear markets can provide insights into current market strategies.

Basic Strategies for Navigating Bear Markets

Let’s break it down into actionable strategies that you can implement in a bear market:

1. Dollar-Cost Averaging

One of the simplest yet effective strategies during bear markets is dollar-cost averaging (DCA). This involves purchasing fixed amounts of cryptocurrency at regular intervals, regardless of the price fluctuations.

- This method reduces the impact of volatility.

- It allows you to build your position over time.

2. Diversification

Like any other investment portfolio, maintaining a diversified cryptocurrency portfolio can offer protection against market downturns. Consider:

- Investing in a mix of established coins and promising altcoins.

- Considering assets that are less correlated with Bitcoin, such as stablecoins.

- Exploring emerging markets; for instance, Vietnam has shown a growth rate of roughly 32% in crypto users in 2024.

3. Utilize Stop-Loss Orders

Another approach to safeguarding your investments during a bear market is through stop-loss orders. This tool automatically sells your asset when it reaches a predetermined price, limiting your downside risk.

Remember, using stop-loss orders can help you avoid emotional decisions during market volatility.

Advanced Tactics for Sophisticated Investors

While basic strategies provide a solid foundation, more advanced tactics can help professional traders thrive:

1. Hedging with Options

Options trading allows you to hedge against potential losses while still maintaining long positions. Here are some techniques:

- Buying put options can offer protection if prices fall.

- Selling call options on holdings can generate additional income.

2. Short Selling

Short selling is an advanced trading strategy that involves borrowing cryptocurrencies to sell at current prices and repurchasing when values drop. While it can magnify profits, it also involves higher risks, especially in volatile environments.

3. Engaging in Staking and Yield Farming

Even in bear markets, certain protocols allow you to earn passive income through staking and yield farming. By holding assets in a proof-of-stake platform, you can earn rewards that can offset losses.

Community Engagement and Collective Wisdom

Connecting with fellow investors and communities can provide insights and support. Consider:

- Joining local crypto groups in Vietnam.

- Engaging in discussions on platforms like Reddit or Discord to share strategies.

Leveraging Local Market Trends

Vietnam is becoming a hotbed for crypto growth, making it essential to factor in local trends:

- The average growth rate of crypto users in Vietnam indicates a rising interest.

- Investing in local projects can also yield potential rewards as the market develops.

Staying Informed is Key

Continuously educating yourself is essential in the cryptocurrency space. Follow trusted sources, read books, attend webinars, and stay updated on regulatory news that may impact your investments.

Valuable Tools and Resources

Utilizing the right tools can simplify your trading and portfolio management:

- Ledger Nano X: A robust hardware wallet that reduces hacks by 70%.

- CoinGecko: A comprehensive platform for tracking cryptocurrency prices and market capitalization.

- TradingView: Essential for chart analysis and trading strategies.

Conclusion: Navigating Bear Markets

In conclusion, bear market periods in the crypto space require robust strategies and a calm approach. By implementing sound investments, diversifying your portfolio, and following market trends, it’s possible to navigate these turbulent times effectively. Always remember that bitcoin10000 is here to support you in your crypto journey, offering insights and tools.

It’s essential not to view bear markets solely as negative phases; they can also provide opportunities to build a stronger portfolio. So keep your strategies flexible and adapt to market conditions for continued success in the crypto realm.

**Author: Richard Carmichael**

Cryptocurrency analyst and thought leader with over 50 publications in the blockchain domain. Featured in numerous financial conferences for his insights on market trends and security audits.