Mastering Technical Analysis: A Crypto Guide

In the fast-paced world of cryptocurrency, where $4.1 billion was lost to DeFi hacks in 2024, understanding the markets becomes crucial. Technical analysis offers investors tools to make informed decisions based on price movements and trading volume. This extensive guide will delve into technical analysis, providing insights that cater to beginners and seasoned traders alike.

Understanding Technical Analysis

Technical analysis is the study of price movements and patterns in the market. It relies on historical data to forecast future price actions. But here’s the catch – unlike fundamental analysis, which considers the intrinsic value of an asset, technical analysis focuses solely on price and volume. This approach can provide a predictive edge in trading.

Basics of Price Action

- Price movement is influenced by supply and demand.

- Trends can be upwards, downwards, or sideways.

- Understanding candlestick patterns is essential for interpreting price action.

Key Indicators in Technical Analysis

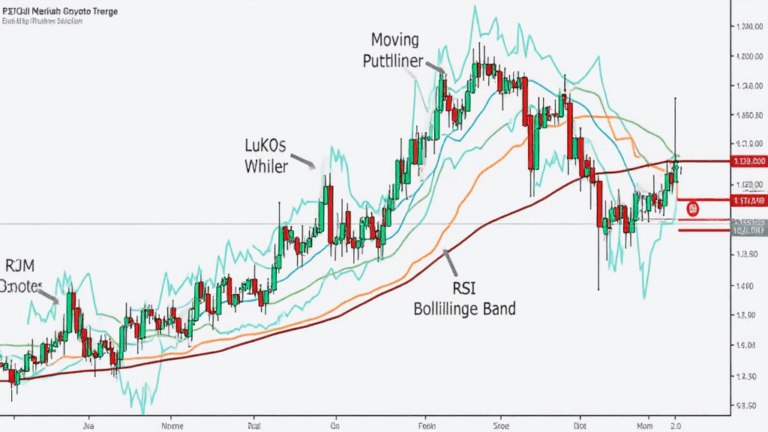

Here’s where it gets interesting! Several indicators help traders make sense of market movements:

- Moving Averages: These smooth out price data to identify trends over a specific period.

- Relative Strength Index (RSI): This oscillator measures the momentum of price changes, helping traders identify overbought or oversold conditions.

- Bollinger Bands: These bands consist of a simple moving average and two standard deviations, helping traders gauge volatility.

Using Indicators in Practice

Let’s break it down with an example. If the RSI shows values above 70, it indicates that the asset is overbought, while values below 30 suggest it is oversold. Successful traders often combine multiple indicators to gain a clearer picture of market conditions.

Chart Patterns: The Visual Language of Trading

Chart patterns, like flags or head and shoulders, often indicate potential reversals or continuations of trends. Recognizing these patterns can be akin to reading the pulse of the cryptocurrency market.

Popular Chart Patterns

- Head and Shoulders: This pattern often signals a reversal in trend.

- Double Top and Bottom: These patterns indicate potential price reversals.

- Flags and Pennants: These continuation patterns suggest a brief pause before the existing trend resumes.

Risk Management in Trading

No trading strategy is complete without solid risk management. Successful traders know when to enter and exit trades, minimizing losses and maximizing profits.

Strategies for Effective Risk Management

- Setting Stop-Loss Orders: Automatically exit trades when prices reach a certain level.

- Position Sizing: Determine how much capital to allocate based on overall portfolio size.

- Trailing Stops: Adjust stop-loss orders to lock in profits as the trade moves in one’s favor.

The Importance of Backtesting

Backtesting involves simulating a trading strategy using historical data. This process allows traders to evaluate how well a strategy would have performed in the past, essentially providing insights into potential effectiveness.

Key Steps in Backtesting

- Select a trading strategy.

- Gather historical price data for the asset.

- Simulate trades based on the strategy.

- Analyze the results and fine-tune the strategy based on performance.

According to a recent report, as the Vietnamese cryptocurrency market continues to expand, with user growth projected to soar by 150% in 2025, leverage technical analysis to navigate this promising landscape.

Conclusion

Mastering technical analysis can significantly enhance your trading strategy. By understanding indicators, chart patterns, and the importance of risk management, you can better navigate the volatile waters of cryptocurrency trading. Above all, always remember that while technical analysis is a valuable tool, it should be used in conjunction with a solid understanding of market fundamentals.

For more insights into trading strategies, visit hibt.com. And remember, consulting with financial advisors is essential as this guide does not constitute financial advice. Keep learning and stay informed in this ever-evolving market!

Author: Dr. Alex Nguyen, a seasoned financial analyst with over 20 published works in blockchain technology and compliance, has led audits for prominent crypto projects.